Tesla and Google, which kicked off the second-quarter earnings reports for tech giants, fell short of expectations, triggering investors' pessimistic sentiment towards the AI bubble. This led to the Nasdaq and S&P 500 indices closing down 3.64% and 2.31% respectively, marking the largest single-day drop since the end of 2022, and causing a collapse across all US stock indices. The Dow Jones Industrial Average plummeted by 500 points, the small-cap index fell by 2.1%, the chip index dropped by 5.4%, and the China concept index fell by nearly 2%. Due to investors' disappointment in the prospects of artificial intelligence, the market value of the Nasdaq 100 component stocks evaporated by $1 trillion on Wednesday.

Risk aversion increased, and traditional safe-haven stocks in the US performed well. The utilities sector was one of the only three sectors to rise, with utility stocks mainly consisting of high-dividend stocks, particularly benefiting from lower interest rates. The energy sector also closed higher, while technology, discretionary consumer goods, and communication services fell by about 4%.

The US July Markit manufacturing PMI initial value unexpectedly shrank to a seven-month low, and US new home sales in June fell for two consecutive months to the lowest annualized total since November last year, adding signs of a slowdown in the US economy. Dudley, the former "third in command" of the Federal Reserve, called for a rate cut next week, once again heating up market expectations for a rate cut, and the weakening dollar supported the rebound of precious metals and oil prices. However, the dollar still hovered at a two-week high, and the US July Markit services PMI initial value reached a 28-month high.

Advertisement

Internationally, traditional safe-haven currencies, the Japanese yen and Swiss franc, rose sharply, with the yen also boosted by reports that the Bank of Japan will consider raising interest rates next week. Germany's July PMI unexpectedly fell, and the eurozone's manufacturing PMI initial value reached a seven-month low, while the UK's business activity warmed up due to strong manufacturing growth. The Bank of Canada, as expected, cut interest rates by 25 basis points and maintained a dovish stance afterward, causing the Canadian dollar to fall, and the two-year Canadian bond yield to reach its lowest level since May last year.

Technology stock performance did not meet expectations, causing the US stock market to collapse, with technology and chip stocks plummeting. Tesla fell by more than 12%, Nvidia fell by nearly 7%, and Google A fell by 5%.

On Wednesday, July 24th, the disappointing performance of tech giants Tesla and Google led to investors' disappointment and exit, causing technology stocks to fall across the board, dragging the main US stock indices to plummet, accelerating the dive at the end of the day, and closing at the daily low.

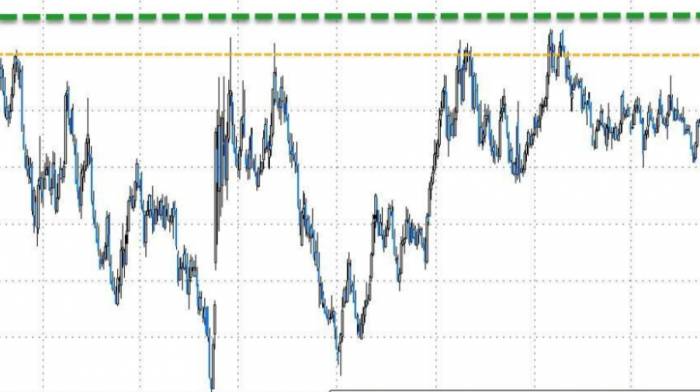

The Nasdaq, dominated by technology stocks, and the Nasdaq 100, once fell by more than 3.6%, marking the largest intraday drop since December 2022. The S&P 500 index fell by more than 2.4% at its lowest point, and the Dow Jones Industrial Average, which is rich in blue-chip stocks, fell by nearly 1.4% at its deepest point:

The S&P 500 index closed down 128.61 points, a drop of 2.31%, marking the worst single-day performance since December 2022, at 5,427.13 points. The Dow Jones Industrial Average closed down 504.22 points, a drop of 1.25%, at 39,853.87 points. The Nasdaq closed down 654.94 points, a drop of 3.64%, at 17,342.41 points.

The Nasdaq 100 fell by 3.65%, marking the largest single-day drop since 2022; the Nasdaq Technology Market Value Weighted Index (NDXTMC), which measures the performance of technology industry components in the Nasdaq 100, fell by 4.73%; the Russell 2000 index fell by 2.13%; the VIX fear index rose by 22.55% to 18.04, reaching a three-month high.

The Dow Jones Industrial Average had the smallest drop, but still fell by more than 1.2%.Most of the 11 sectors of the S&P 500 Index closed lower. The Information Technology/Tech sector fell by 4.14%, the Consumer Discretionary sector by 3.89%, the Telecommunications sector by 3.76%, and the Industrial sector by 2.17%. The Real Estate, Materials, and Financial sectors saw the smallest declines of at least 1.19%. The Energy sector rose by over 0.2%, the Healthcare sector by over 0.8%, and the Utilities sector by over 1.1%.

In terms of investment research strategy:

According to media-compiled data, last week the S&P 500 Index was once 15% above its 200-day moving average, with a deviation comparable to historical extremes, greater than before the sharp decline in early 2018. In recent history, larger deviations have only been seen after the low point following the global financial crisis in March 2009, the high point in February 2011, and the low point following the pandemic in 2021.

Andrew Thrasher, a technical analyst and portfolio manager at Financial Enhancement Group, stated that while this does not necessarily mean the market is about to crash, it is a warning signal for investors concerned about high valuations and concentration risks in tech stocks. We are encouraged by the inflow of funds into small-cap stocks and other lagging sectors, but the biggest question is that six stocks still account for about 30% of the S&P 500 Index. If funds quickly rotate from these growth stocks to other areas, it will be difficult for the overall index to maintain an upward trend in the short term.

The "Tech Seven Sisters" were all wiped out, with their total market value shrinking by nearly $1.75 trillion from its peak ten days ago. Tesla closed down 12.33%, marking its largest single-day decline since September 2020. Nvidia fell 6.8%, Meta dropped over 5.6%, Google A fell 5.04%, its largest drop since the end of January in six months, Microsoft fell about 3.6%, Amazon fell about 3%, and Apple fell about 2.9%.

Chip stocks suffered a complete collapse. The Philadelphia Semiconductor Index fell by 5.41%; the industry ETF SOXX fell by 5.32%; the Nvidia double long ETF fell by 13.24%.

ASM International ADR fell by over 12.2%, Advanced Micro Devices fell by over 9.1%, Arm Holdings fell by about 8.2%, ASML ADR fell by over 6.4%, AMD fell by about 6.1%, TSMC ADR fell by 5.9%, GlobalFoundries fell by over 3.8%, Micron Technology fell by about 3.5%, and Seagate Technology closed up by over 4%. Broadcom fell by 7.6%.

AI concept stocks were hit hard. BullFrog AI fell by 11.71%, "Nvidia concept stock" Serve Robotics fell by 8.94%, Oracle fell by 3.03%, Snowflake fell by 5.26%, Palantir fell by 7.67%, CrowdStrike fell by 3.99%, BigBear.ai fell by 0.65%, Nvidia concept stock SoundHound fell by 7.89%, and Dell fell by 7.73%.

Most Chinese concept stocks fell. The NASDAQ Golden Dragon China Index (HXC) fell by 1.93%, among ETFs, the China Technology Index ETF (CQQQ) fell by 2.13%, and the China Internet Index ETF (KWEB) closed down by 2.10%.

Among popular Chinese concept stocks, NIO fell by 4.02%, XPeng Motors fell by 4.17%, Zeekr fell by 7.73%, Li Auto fell by 4.61%, Bilibili fell by 2.56%, JD.com fell by 1.64%, Tencent Holdings (ADR) fell by 1.49%, Alibaba fell by 0.39%, Baidu fell by 1.79%, Pinduoduo fell by 0.91%, while NetEase rose by 1.16%.In addition, among AI stocks, IBM's revenue exceeded expectations, claiming that generative AI brought in over $2 billion in book value, with the stock price rising by more than 4% after hours. Among chip stocks, KLA's revenue and profit for the fourth fiscal quarter both exceeded expectations, with the stock price rising by more than 5% after hours. Ford Motor's second-quarter EPS was worse than expected, but it still expects Ford Pro's EBIT to lose at least $5 billion for the full year, with the stock price falling by more than 10% after hours. The American fast-food chain Chipotle's same-store sales in the second quarter once exceeded 11%, with an increase that exceeded market expectations, and the stock price rose by more than 14% after hours.

Investors weighed the performance of regional banks and American technology companies, and European stocks fell collectively, ending two days of consecutive gains:

The pan-European Stoxx 600 index closed down 0.61% at 512.30 points. The Eurozone STOXX 50 index closed down 1.12% at 4861.87 points.

The German DAX 30 index closed down 0.92%. The French CAC 40 index closed down 1.12%. The Italian FTSE MIB index closed down 0.48%. The British FTSE 100 index closed down 0.17%. The Dutch AEX index closed down 1.26%. The Spanish IBEX 35 index closed down 0.02%.

Most European semiconductor concept stocks closed lower, and luxury brands almost all closed lower:

Among chip stocks, ASM International closed down 9.43%, BE Semiconductor Industries fell 8.49%, ASML Holdings fell by more than 4.6%, Germany's Aixtron fell 2.9%, Infineon fell by more than 1.4%, STMicroelectronics fell 0.43%, while Soitec rose 2.45%.

Among luxury brands, LVMH Group closed down 4.66%, Remy Cointreau fell 4.6%, Kering Group fell 4.54%, Hugo Boss, Hermès, Burberry, Compagnie Financière Richemont, and Pernod Ricard also fell between 3.42% and 1.54%.

Deutsche Bank's second quarter ended a record of 15 consecutive quarters of profitability, marking the first loss in four years, and announced the abandonment of the second round of stock buybacks for the year, impacted by weak trading and litigation, increasing provisions for non-performing loans in corporate and commercial real estate, casting a shadow over European banking industry reports, with its US stocks falling by more than 9% and European stocks falling by more than 8%, the largest drop in nearly three months.

Expectations for interest rate cuts heated up, and the yield on two-year US Treasury bonds fell by more than 8 basis points, with the yield curve steepening

At the end of the day, the two-year US Treasury bond yield, which is more sensitive to monetary policy, fell by 8.13 basis points to 4.4101%, trading in the range of 4.4934%-4.3750%, falling to the lowest in more than five months since early February. The yield on the 10-year US benchmark Treasury bond rose by 2.15 basis points to 4.2720%, trading in the range of 4.2076%-4.2877%.Yields on U.S. Treasury bonds with maturities ranging from 10 to 30 years have seen their increases widen, with the yield curve becoming steeper. The spread between the 5-year and 30-year U.S. Treasury yields has reached a new high since May 2023, while the spread between the 2-year and 30-year yields has hit a new high since July 2022. This is primarily due to the market's rising expectations for interest rate cuts, with Dudley, the former "third in command" at the Federal Reserve, calling for a rate cut as early as next week.

European debt also shows a divergent trend, with short-term bond yields falling and long-term yields rising. The benchmark 10-year German bund yield increased by 0.5 basis points to 2.444%, trading within the range of 2.408%-2.455%. After the release of the Eurozone PMI data at 16:00 Beijing time, it hit a daily low before rebounding. The 2-year German bund yield fell by 6.4 basis points, reaching a daily low of 2.651%, and remained in a downtrend throughout the day, showing a generally declining trend with fluctuations.

The decline in U.S. EIA crude oil inventories, the rise in gasoline demand, the Canadian wildfires, and the prospect of a rate cut in September have supported a rebound in oil prices by more than 0.8%, ending a four-day losing streak.

A weaker dollar has boosted oil prices. WTI crude oil futures for September settled up by $0.63, a gain of about 0.82%, at $77.59 per barrel. Brent crude oil futures for September settled up by $0.70, a gain of about 0.86%, at $81.71 per barrel.

U.S. oil continued its earlier intraday gains and accelerated its rise during the U.S. stock market's midday trading, with the highest increase nearing 1.6%, breaking through the $78 mark, while Brent oil rose by more than 1.5%, breaking through the $82 mark.

The U.S. Energy Information Administration (EIA) reported that for the week ending July 19, U.S. crude oil inventories decreased by 3.7 million barrels to a new low since February, while gasoline inventories unexpectedly fell by 5.6 million barrels. The market supply of gasoline (reflecting demand) increased by 673,000 barrels per day. Goldman Sachs pointed out that although Canada's oil production remains stable, the most severe period of the wildfire season is approaching, which could pose a risk to oil supplies.

U.S. natural gas futures for August fell by 3.20%,报价 at $2.117 per million British thermal units. The European benchmark TTF Dutch natural gas futures rose by 3.16%,报价 at €32.621 per megawatt-hour; ICE UK natural gas futures closed up by 2.21%,报价 at 80.76 pence per thousand calories.

As interest rate cut trades heat up, the U.S. dollar index fell slightly by about 0.1%, while the yen rose by more than 1.1%, approaching 153 and hitting a two-month high.

The U.S. dollar index DXY, which measures the value against a basket of six major currencies, fell by 0.09% to 104.357 points, with intraday trading ranging from 104.555 to 104.122 points.

The Bloomberg Dollar Index fell by 0.02% to 1256.94 points, with intraday trading ranging from 1257.92 to 1254.51 points.Non-US currencies mostly declined. The euro fell by 0.12% against the US dollar, the British pound remained unchanged against the US dollar, and the US dollar fell by 0.66% against the Swiss franc.

The offshore renminbi (CNH) appreciated by 228 points against the US dollar,报价7.2663 yuan, with overall trading ranging from 7.2916 to 7.2619 yuan.

Among Asian currencies, the US dollar fell by 1.13% against the Japanese yen,报价153.83 yen, with intraday trading ranging from 155.99 to 153.11 yen, marking the first time since mid-May that it has fallen below the 154 level. The euro fell by 1.26% against the yen,报价166.75 yen; the British pound fell by 1.12% against the yen,报价198.557 yen. Media reports suggest that the Bank of Japan plans to halve its bond purchases over the next few years at its policy meeting next week and is considering whether to raise interest rates.

On the second day following the listing of Ethereum spot ETF, mainstream cryptocurrencies experienced mixed gains and losses. Bitcoin, the largest by market value, rose by 0.75% to $66,060.00, regaining the $66,000 level, with an intraday high of $67,230.00. Ethereum, the second largest, fell by 3.21%,报价$3,378.00, with intraday trading ranging from $3,503.00 to $3,357.00.

Traders focused on economic data, with the market fully pricing in a rate cut in September, and increased gold demand in India, supporting two consecutive days of gold price increases.

The US dollar and US Treasury yields declined together, supporting precious metal prices. COMEX August gold futures rose slightly by 0.06% to $2,408.7 per ounce at the end of the day, breaking a four-day losing streak, while COMEX September silver futures fell by 0.53% to $29.175 per ounce at the end of the day.

Spot gold prices maintained an upward trend throughout the day, continuing to rise before the US stock market opened, and surged by more than 0.9% during the early US stock market session, climbing above $2,430 per ounce, but then almost gave up most of the gains, approaching the $2,400 per ounce level, and only slightly rose at the close of the US stock market.

Spot silver fluctuated upwards before the US stock market opened, with a gain of more than 0.7% at the highest point during the early session. However, it then plummeted and turned negative,刷新日低 at the end of the day, falling by more than 0.9% and breaking below the $29 per ounce level.

Analysis suggests that the most significant positive factor for gold prices at present is the prospect of interest rate cuts, with the market focusing on this week's economic data and firmly believing that the Federal Reserve will start cutting interest rates this year, and a weaker US dollar supports the rise in gold prices. In addition, India's reduction of import duties on gold and silver from 15% to 6% also helps to increase the demand for gold and silver.

London's basic industrial metals have mostly declined for several consecutive days. The economic barometer "Dr. Copper" fell by $62,报价$9,104 per ton, and both it and the New York copper September contract have fallen for eight consecutive trading days, reaching a new low since early April.LME zinc closed down by $4, at $2,685 per ton. LME lead closed down by $16, at $2,044 per ton. LME nickel closed down by $194, a decrease of 1.21%, at $15,827 per ton. Meanwhile, LME tin closed up by $372, a gain of over 1.26%, at $29,790 per ton. LME aluminum closed up by $6, at $2,300 per ton.