On Wednesday, the Bank of Canada lowered its interest rate by 25 basis points, from 4.75% to 4.5%, in line with market expectations. This marks the second consecutive meeting following the rate cut in June where the Bank of Canada has reduced rates. The latest indications from the Bank of Canada suggest further rate cuts are on the horizon as inflation concerns diminish.

In June of this year, Canada became the first G7 country to cut interest rates, initiating an easing cycle. The Bank of Canada reduced its rate by 25 basis points in June, from 5% to 4.5%, which was also in line with market expectations. Subsequently, the European Central Bank also chose to lower its rates. The Federal Reserve is expected to join the rate-cutting trend within this year.

The recent alleviation of inflationary pressures in Canada and the central bank's inflation forecasts have prompted the decision to cut rates. The Bank of Canada stated that after rising in May, the Consumer Price Index (CPI) fell to 2.7% in June. Overall inflationary pressures are easing, and the Bank of Canada continues to make progress in controlling price pressures. The Bank of Canada's preferred core inflation indicator has been below 3% for several months, and the price increases in various components of the CPI are now close to historical normal levels, with a return to the 2% inflation target on the horizon.

Advertisement

The Bank of Canada indicated that although wage growth remains high, it is slowing down as the labor market decelerates. Corporate pricing behavior has largely normalized, and inflation expectations have declined. In June, the last paragraph of the Bank of Canada's policy statement focused heavily on these concerns, but the July statement was revised to focus on ongoing supply surpluses and opposing forces affecting inflation.

The Bank of Canada believes that a weak economy is suppressing the CPI, but housing and the service industry are hindering inflation progress, with housing prices and service costs providing support to the CPI.

The Bank of Canada's preferred core inflation indicator is expected to slow down to around 2.5% in the second half of 2024 and continue to gradually cool down in 2025. The bank anticipates that CPI inflation will be lower than core inflation in the second half of this year, primarily due to the base effect of gasoline prices. As these effects gradually fade, CPI inflation may rise again and then stabilize near the 2% target next year.

The Bank of Canada noted weak household spending on housing and consumer goods. The bank expects Canada's GDP growth to return to above potential levels by 2025.

Bank of Canada Governor Macklem stated that if inflation continues to slow down, another rate cut may be possible, and it is reasonable to expect further rate cuts. The decision to lower rates by 25 basis points at the July 24 monetary policy meeting was a clear consensus. The Bank of Canada is not on a preset path for rate cuts and will make interest rate decisions meeting by meeting. The divergence from the Federal Reserve's monetary policy path may not be severe.

Macklem also stated that a more balanced approach to various risks is needed. As the target is achieved and supply surpluses in the economy intensify, downside risks are playing an increasingly important role in our monetary policy deliberations.

Regarding the unemployment rate of new immigrants and young people, Macklem considers it a signal of economic/labor market slack. The Bank of Canada stated in its statement that there are more signs of weakness in the labor market, and job seekers are taking longer to find jobs.Senior Deputy Governor of the Bank of Canada, Rogers, stated that the central bank's balance sheet has not yet reached the level it should be at. The central bank can afford to be somewhat indifferent to the interest rate costs of mortgage loans. It is a mistake to rely on interest rates to solve housing issues.

Media analysis suggests that there has been a significant shift in the Bank of Canada's stance:

The Bank of Canada's attitude towards inflation has undergone a noticeable change. Discussions at the June meeting revealed that policymakers had debated whether more evidence of cooling inflation was needed before easing monetary policy. Now they are more convinced that they have sufficient evidence.

The balance of risks is also changing. Officials listed lower-than-expected household spending as the main downside risk and pointed out that the upcoming mortgage renewals pose a risk to consumption growth.

Overall, Bank of Canada officials seem more convinced that price pressures have been controlled and are increasingly focused on a soft economic landing. Their dovish series of communications indicate that the central bank has shifted its focus to ensuring that inflation does not significantly fall below the 2% target.

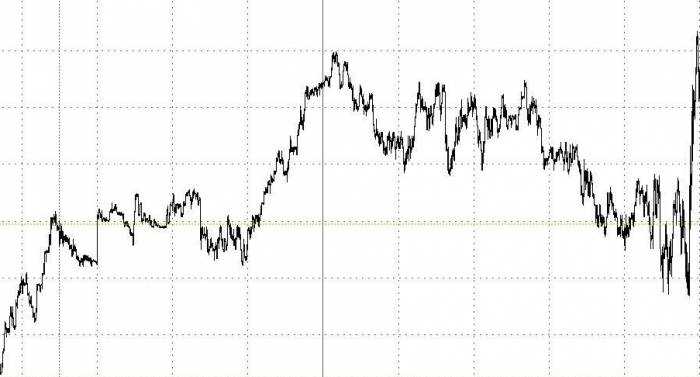

After the Bank of Canada announced a rate cut of 25 basis points, the US dollar against the Canadian dollar rose nearly 15 points in the short term, reporting at 1.3790. The two-year Canadian bond yield slightly declined in the short term, refreshing the daily low to 3.638%, with the overall daily decline expanding to 7 basis points. Following the speeches of high-ranking Bank of Canada officials, the two-year government bond yield fell further, dropping 11 basis points during the day, refreshing the daily low below 3.6%.