Overseas, U.S. tech stocks experienced their darkest day in the past year and a half: the Nasdaq Composite closed down 3.6%, marking the largest drop since the end of 2022, with Tesla plummeting 12%, Meta falling nearly 7%, and Google dipping 5%.

The driving forces behind this are, on one hand, Tesla and Google's initial defeat in the Q2 earnings season among the U.S. stock market's "Seven Sisters," and on the other hand, a series of data released on the same day suggest that the U.S. economy may be heading towards an inevitable "hard landing."

Overseas data indicated that the U.S. July Markit manufacturing PMI preliminary value unexpectedly shrank to a seven-month low, and U.S. new home sales continued to decline for two consecutive months in June to the lowest annualized total since November last year. The situation in Europe is also not optimistic, with Germany's economic sentiment falling below the "boom-or-bust line" for the first time in four months, and France's manufacturing output decreasing for the 26th consecutive month.

At the same time, some popular indicators of economic recession, such as the yield curve and the Sahm Rule, are continuously sounding alarms.

Advertisement

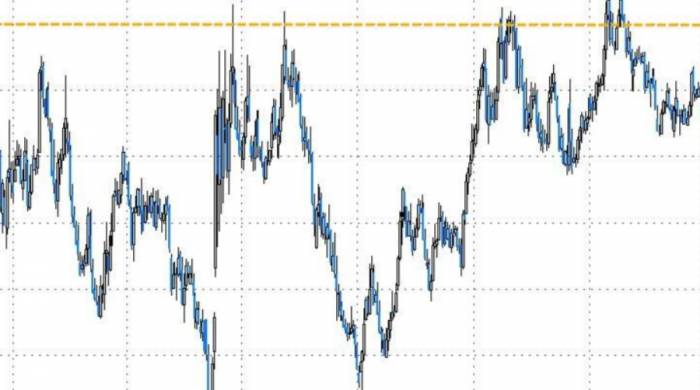

The yield curve inversion, which has lasted for two years, is the longest period in history, yet an economic recession has not arrived as expected.

The Sahm Rule, a recession prediction method based on changes in the unemployment rate, has recently sent some unfavorable signals.

According to the Sahm Rule, when the three-month average unemployment rate increases by 0.5 percentage points compared to the previous 12 months, the economy may be in a recession. As of June, this gap was 0.43 percentage points.

However, some analyses suggest that the current changes in the unemployment rate may be more influenced by the post-pandemic recovery of the labor market rather than a direct signal of economic recession.

Citi's latest research points out that the U.S. economy may currently be at a turning point, and if the labor market continues to weaken, it may trigger the recession that economists have warned about.The coming weeks will determine whether the recent weakness is merely seasonal or the beginning of a broader economic slowdown. The agency considers the number of initial jobless claims as a key piece of data, especially if this figure continues to rise and diverges from the Challenger job-cut data, which is on a downward trend, indicating a worsening labor market. On Thursday evening, the Bureau of Labor Statistics (BLS) will release the initial claims data for last week.

Another commonly used experience is that two consecutive quarters of GDP contraction equate to a recession, so the market is also watching whether the second-quarter GDP released on Thursday will trigger a red alert.

Wall Street is currently widely expecting the U.S. second-quarter real GDP annualized quarter-on-quarter preliminary estimate to rise from the first quarter's 1.4% to 2%, with the economy still in positive growth.

Is the recession indicator failing?

Traditional recession indicators, such as the temporary employment rate and the yield curve, have performed well in past predictions. However, the current economic environment seems to have greatly reduced the reliability of these indicators.

According to the latest statistics from the BLS, after peaking in March 2022, the number of temporary jobs has decreased by 515,000, a 16% drop, up to now. However, total employment is still rising, which is different from the situation before previous economic recessions.

Austan Goolsbee, the President of the Chicago Federal Reserve, previously stated: "The decline in temporary employment may no longer directly reflect the economic situation as it did in the past. The labor shortage during the pandemic has led employers to change their reliance on temporary workers."

Former Federal Reserve economist Claudia Sahm also warned: "The business cycle triggered by the pandemic is very unusual, and traditional recession prediction methods may no longer be effective."

In addition, although the U.S. GDP contracted negatively in the first and second quarters of 2022, broader economic indicators such as employment, personal income, and consumer spending have not shown obvious signs of recession.